Read Time5 Mins

“What gets measured gets managed.” — Peter Drucker

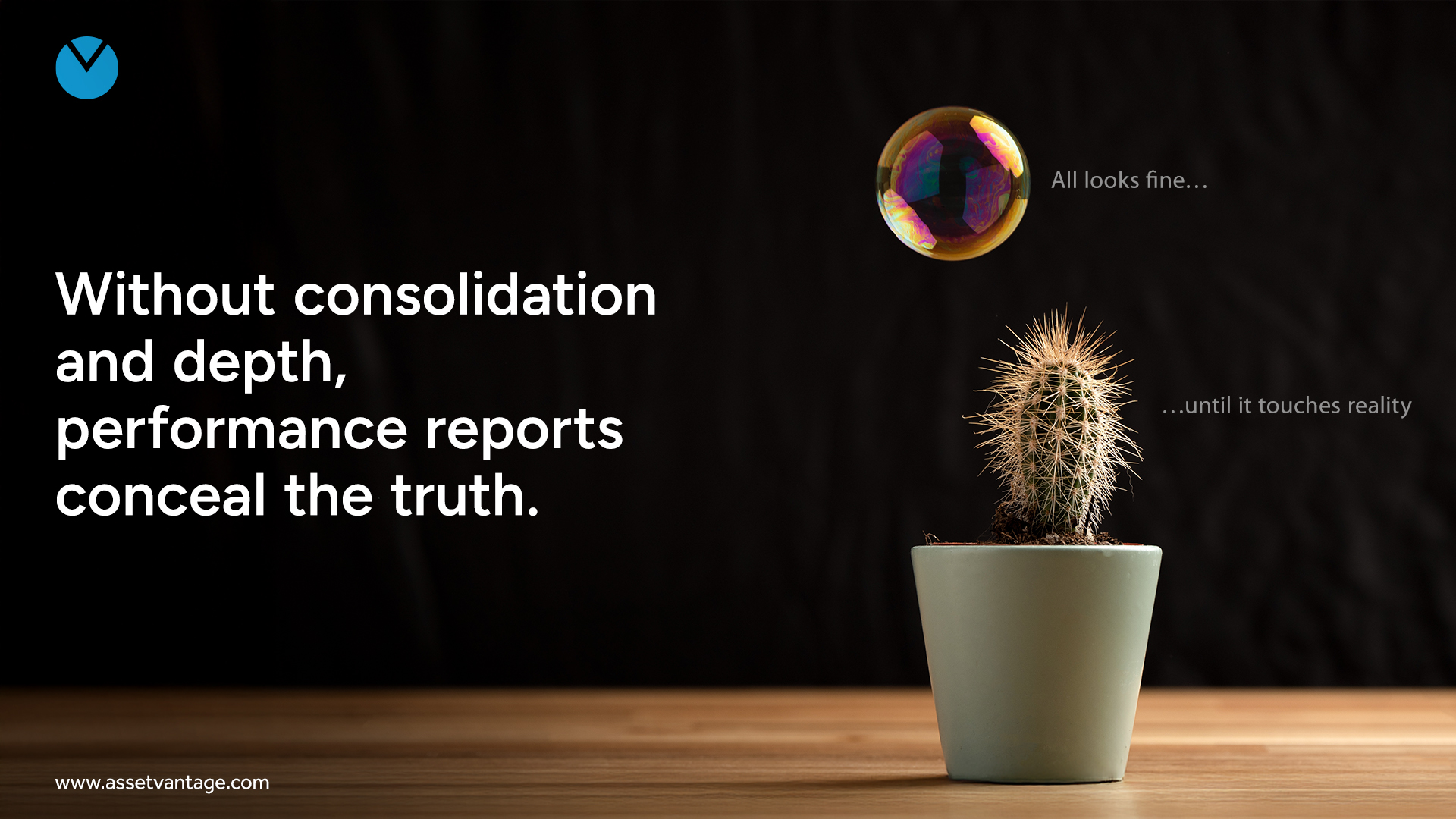

Managing wealth across generations isn’t just about numbers on a page. It’s about context. Precision. Awareness. And above all, clarity.

Even the most capable teams are often limited by the tools they use. Without the right family office software, performance reporting turns reactive instead of strategic. According to McKinsey, family offices with assets under management (AUM) below $100 million can see operating costs rise as high as 6% of AUM—a significant drag on long-term returns if performance isn’t monitored with discipline.

The truth is most family offices don’t underperform because they are negligent. They miss it because their systems aren’t built to empower better decision making.

If you’re relying on PDF snapshots, patchworked spreadsheets, and delayed monthly reconciliations, you’re not getting the real-time picture of your portfolio—you’re seeing a delayed interpretation of it.

These 10 questions are meant to stir reflection. They’re not a checklist. They’re an invitation to re-evaluate how deeply your family measures the outcomes of its decisions.

1. Are you truly seeing the full picture—or just the parts that are easy to measure?

Family offices often lean on what’s accessible: public equity returns, mutual fund gains, bank balances. But what about private equity, real estate, collectibles, or commitments to AIFs? If it’s not included—or worse, misvalued—then what you’re calling “performance” is a mirage.

2. Do you know your IRR and TWR—and more importantly, when to use each?

IRR reflects the actual rate of return based on cash flows. TWR strips out the noise of inflows and outflows to measure pure investment performance. BOTH MATTER.

3. Is performance measured per entity, or only at a surface level?

Family offices aren’t monoliths—they’re networks of trusts, holding companies, SPVs, and even cross-border investment structures.

4. Are benchmarks selected because they’re accurate—or because they’re convenient?

It’s easy to compare to the S&P 500. But is it relevant to your mix of private credit, venture capital, fixed income, and family-held businesses?

5. Can you isolate which assets are contributing alpha—and which are dead weight?

What’s truly driving performance? Are a few concentrated bets lifting the entire ship, masking a sea of underperformers?

6. How often is your performance data updated—and how much do you trust it?

If your performance is being updated monthly—or worse, quarterly—you’re operating in the past.

More tips: How to Make Smarter Financial Moves Using Structured Intelligence

7. Are your private and alternative investments being marked and reported with discipline?

Private equity isn’t static. Real estate changes in value. Yet many family offices carry these assets at last year’s value or rely on delayed capital account statements.

8. Do your reports reveal risk-adjusted performance—or just top-line returns?

10% from government bonds isn’t the same as 10% from venture capital. Are you evaluating how much risk you’re taking for the returns you’re earning?

9. Can next-gen family members understand your reports without a translator?

If performance reports read like spreadsheets from 1998, your next generation will disengage.

10. Is your performance reporting evolving—or has it looked the same for a decade?

Technology has transformed portfolio intelligence. But many family offices still rely on stitched-together reports, slow reconciliations, or outdated tools.

If your reporting tools haven’t evolved, your performance insights won’t either—and that’s where purpose-built family office software can make all the difference.

“What gets measured gets managed.” — Peter Drucker

Managing wealth across generations isn’t just about numbers on a page. It’s about context. Precision. Awareness. And above all, clarity.

Even the most capable teams are often limited by the tools they use. Without the right family office software, performance reporting turns reactive instead of strategic. According to McKinsey, family offices with assets under management (AUM) below $100 million can see operating costs rise as high as 6% of AUM—a significant drag on long-term returns if performance isn’t monitored with discipline.

The truth is most family offices don’t underperform because they are negligent. They miss it because their systems aren’t built to empower better decision making.

If you’re relying on PDF snapshots, patchworked spreadsheets, and delayed monthly reconciliations, you’re not getting the real-time picture of your portfolio—you’re seeing a delayed interpretation of it.

These 10 questions are meant to stir reflection. They’re not a checklist. They’re an invitation to re-evaluate how deeply your family measures the outcomes of its decisions.

1. Are you truly seeing the full picture—or just the parts that are easy to measure?

Family offices often lean on what’s accessible: public equity returns, mutual fund gains, bank balances. But what about private equity, real estate, collectibles, or commitments to AIFs? If it’s not included—or worse, misvalued—then what you’re calling “performance” is a mirage.

2. Do you know your IRR and TWR—and more importantly, when to use each?

IRR reflects the actual rate of return based on cash flows. TWR strips out the noise of inflows and outflows to measure pure investment performance. BOTH MATTER.

3. Is performance measured per entity, or only at a surface level?

Family offices aren’t monoliths—they’re networks of trusts, holding companies, SPVs, and even cross-border investment structures.

4. Are benchmarks selected because they’re accurate—or because they’re convenient?

It’s easy to compare to the S&P 500. But is it relevant to your mix of private credit, venture capital, fixed income, and family-held businesses?

5. Can you isolate which assets are contributing alpha—and which are dead weight?

What’s truly driving performance? Are a few concentrated bets lifting the entire ship, masking a sea of underperformers?

6. How often is your performance data updated—and how much do you trust it?

If your performance is being updated monthly—or worse, quarterly—you’re operating in the past.

More tips: How to Make Smarter Financial Moves Using Structured Intelligence

7. Are your private and alternative investments being marked and reported with discipline?

Private equity isn’t static. Real estate changes in value. Yet many family offices carry these assets at last year’s value or rely on delayed capital account statements.

8. Do your reports reveal risk-adjusted performance—or just top-line returns?

10% from government bonds isn’t the same as 10% from venture capital. Are you evaluating how much risk you’re taking for the returns you’re earning?

9. Can next-gen family members understand your reports without a translator?

If performance reports read like spreadsheets from 1998, your next generation will disengage.

10. Is your performance reporting evolving—or has it looked the same for a decade?

Technology has transformed portfolio intelligence. But many family offices still rely on stitched-together reports, slow reconciliations, or outdated tools.

If your reporting tools haven’t evolved, your performance insights won’t either—and that’s where purpose-built family office software can make all the difference.

Enter Asset Vantage: The Performance Backbone for Family Offices

Asset Vantage isn’t just another tool. It’s the data backbone that transforms how family offices measure, understand, and act on performance. Built by a family office for family offices, it unifies performance across public, private, and alternative assets—while maintaining accounting-grade accuracy. With Asset Vantage, you get a performance reporting engine, which equips you with the intelligence to measure what truly matters.- Consolidated multi-asset performance across geographies, investment and ownership structures.

- Real-time IRR and TWR calculated intuitively and correctly.

- Per-entity, per-asset, per-advisor performance visibility that reveals what’s working—and what’s not.

- Next-gen ready interfaces that deliver clarity without compromise.

- Integrated accounting and reconciliation, ensuring your performance is always trustworthy and your data is compliance ready.