Read Time5 Mins

According to IBM’s 2024 Cost of a Data Breach report, the average cost of a data breach in the financial sector reached $6.08 million. This stark figure highlights the importance of comprehensive data protection for family offices. Securing financial data should be a top priority not just to prevent loss, but to preserve family legacy and ensure that sensitive information remains protected.

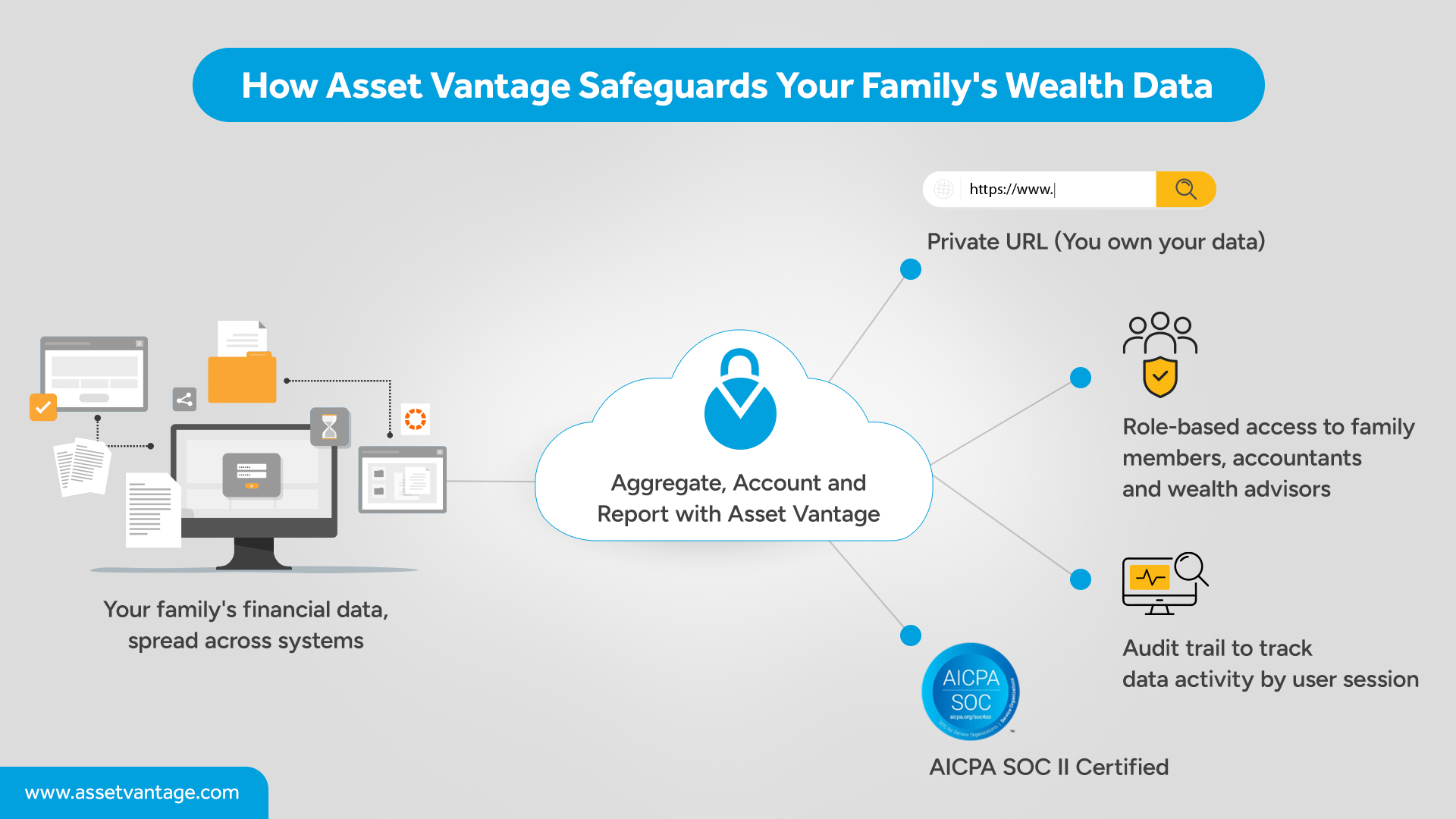

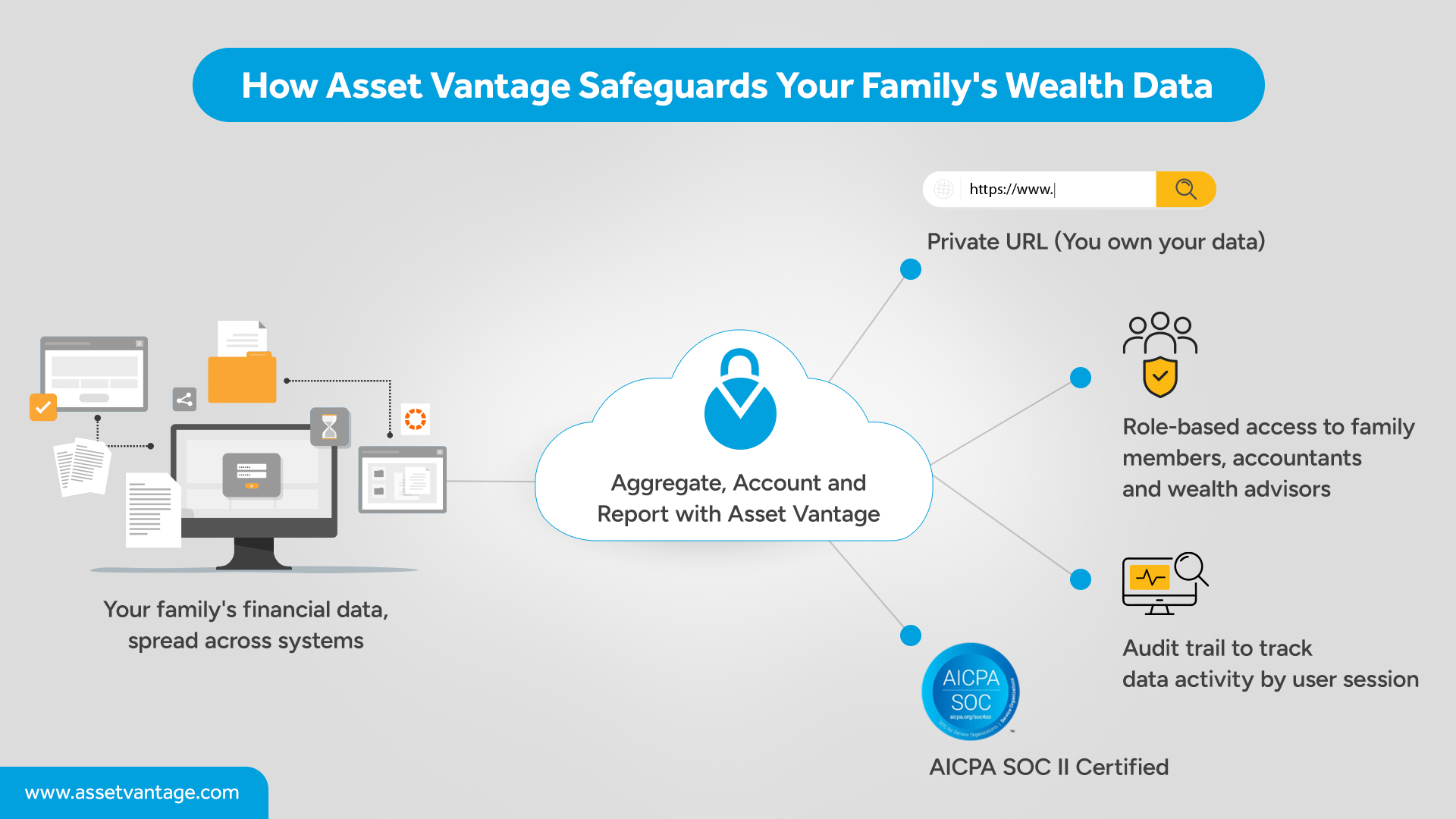

In this blog, we will discuss the various individuals who have access to your family’s financial data, the risks associated with exposing that data, and how Asset Vantage can help safeguard your family’s financial privacy through secure, centralized systems.

Who Has Access to Your Family’s Financial Data?

Understanding who has access to your family’s financial data is the first step in protecting its financial privacy. Many individuals and professionals will need some level of access, but it must be carefully controlled. 1. Internal Stakeholders: These are family members directly involved in managing wealth, including family office principals, their spouses, and heirs. Each member may have different responsibilities and needs for access, which should be clearly defined and managed. 2. External Stakeholders: Professionals such as accountants, tax advisors, investment managers, and legal consultants require access to specific financial information to effectively do their jobs. However, access should be limited to what is necessary to ensure data security. 3. Regulatory Bodies: There will always be a need for oversight by regulatory authorities, but access to sensitive data should be limited to only what is necessary to comply with legal and tax requirements. Recommended: Best Investment Management Software for Family OfficesThe Risks of Exposing Family Financial Data

When financial data is not properly managed, the risks to financial privacy can be severe. Here are five key risks of exposing sensitive financial information, followed by how Asset Vantage addresses each challenge:1. Data Fragmentation

When financial data is spread across disparate systems or stored in disconnected locations, it becomes harder to manage and more prone to errors. Fragmented data can also lead to inefficiencies and increased risks of breaches. How Asset Vantage Helps: Asset Vantage Family Office Software is designed from the ground up to integrate data aggregation, accounting, performance reporting and document storage in a single, unified platform with high levels of privacy and security. AV’s Document Vault feature further enhances efficiency by allowing users to securely upload, tag, and save important documents to specific transactions, investment holdings, or entities—eliminating fragmented record-keeping. Additionally, Asset Vantage’s bank sync feature and data feed engine automate the aggregation of data, further streamlining operations and ensuring a single, reliable source of truth.2. Unauthorized Access and Evolving Family Dynamics

Unauthorized access and changing family dynamics both pose challenges that need to be addressed to ensure financial privacy and security. The first step in protecting financial data is clearly defining who needs access and why, and ensuring that the right permissions are set accordingly. This is especially important as family structures evolve—new heirs, changes in ownership, or new family members joining the financial management team—requiring flexibility in how access is managed. How Asset Vantage Helps: Asset Vantage secures your financial data with SOC 2-certified encryption and secure private cloud, protecting both in-transit and at-rest data. Through its role-based access controls (RBAC), family offices can define roles for each individual, from family members to external advisors, and set specific permissions based on their responsibilities. Whether it’s allowing family members to view high-level reports or giving accountants access to detailed financial statements, these permissions ensure that only the necessary people have access to sensitive information. As the family dynamic changes, Asset Vantage allows administrators to easily adjust access levels—whether adding new heirs or adjusting the role of a family member—without compromising security.