Read Time6 Mins

Providing the right financial reports to Ultra-high-net-worth (UHNW) families is a challenging task as it requires excellent data crunching capabilities, and deep-level understanding of complex investments and ownership structures. Moreover, one-size-fits-all strategy doesn’t work, considering different families have unique financial goals and investment preferences. With varying reporting needs, it is worth considering the following while evaluating a financial reporting software:

1. Who are the intended users and stakeholders of portfolio performance reports?

2. What data is most relevant to them?

3. What do they prefer — an overview of holdings or a drill-down analysis of their investment performance? Or Both?

4. Do they want a basic risk summary or institutional-quality risk metrics to analyze their underlying investments?

5. Can the software protect sensitive family financial data?

6. Does the software provide mobile app integration to access financial reports anytime, anywhere?

1. Portfolio Performance — Evaluating returns with precision

Performance reports allow UHNW families to get a snapshot of how their investments are performing over a particular time range (e.g. weekly, monthly, quarterly, yearly, etc.) and with respect to a benchmark of choice. Here are four essential performance reports you can expect from an advanced family office management software:

1. Portfolio Performance — Evaluating returns with precision

Performance reports allow UHNW families to get a snapshot of how their investments are performing over a particular time range (e.g. weekly, monthly, quarterly, yearly, etc.) and with respect to a benchmark of choice. Here are four essential performance reports you can expect from an advanced family office management software:

Family’s Financial Goals — why they matter most in selecting a financial reporting software

The family’s financial comprehension, presentation preferences, and their short- and long-term goals can help decide the most appropriate financial reporting software. Also, acknowledging generational divides play an important role as older generations favor physical copies of performance reports, while the next generation of family principals prefer digital versions that can be customized on-the-go. Whatever the reason, a financial reporting software must at bare minimum possess the ability to build configurable reports that provide actionable views of family wealth and enable granular analysis of specific asset classes to make informed decisions. A visually appealing reporting interface that presents data impactfully is a valuable bonus. Recommend Read: Best Investment Management Software for Family OfficesTop 6 financial reports that your financial reporting software must generate

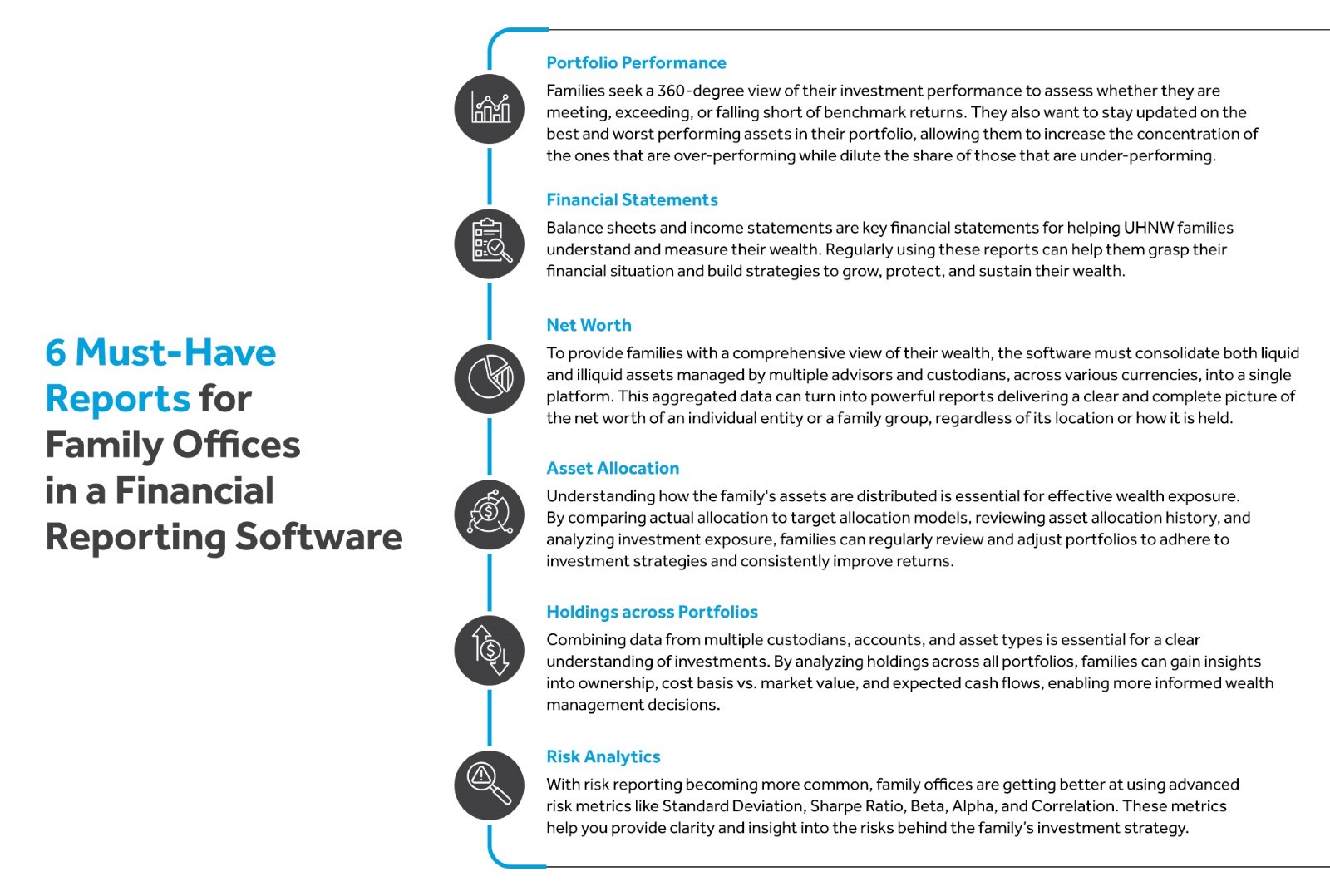

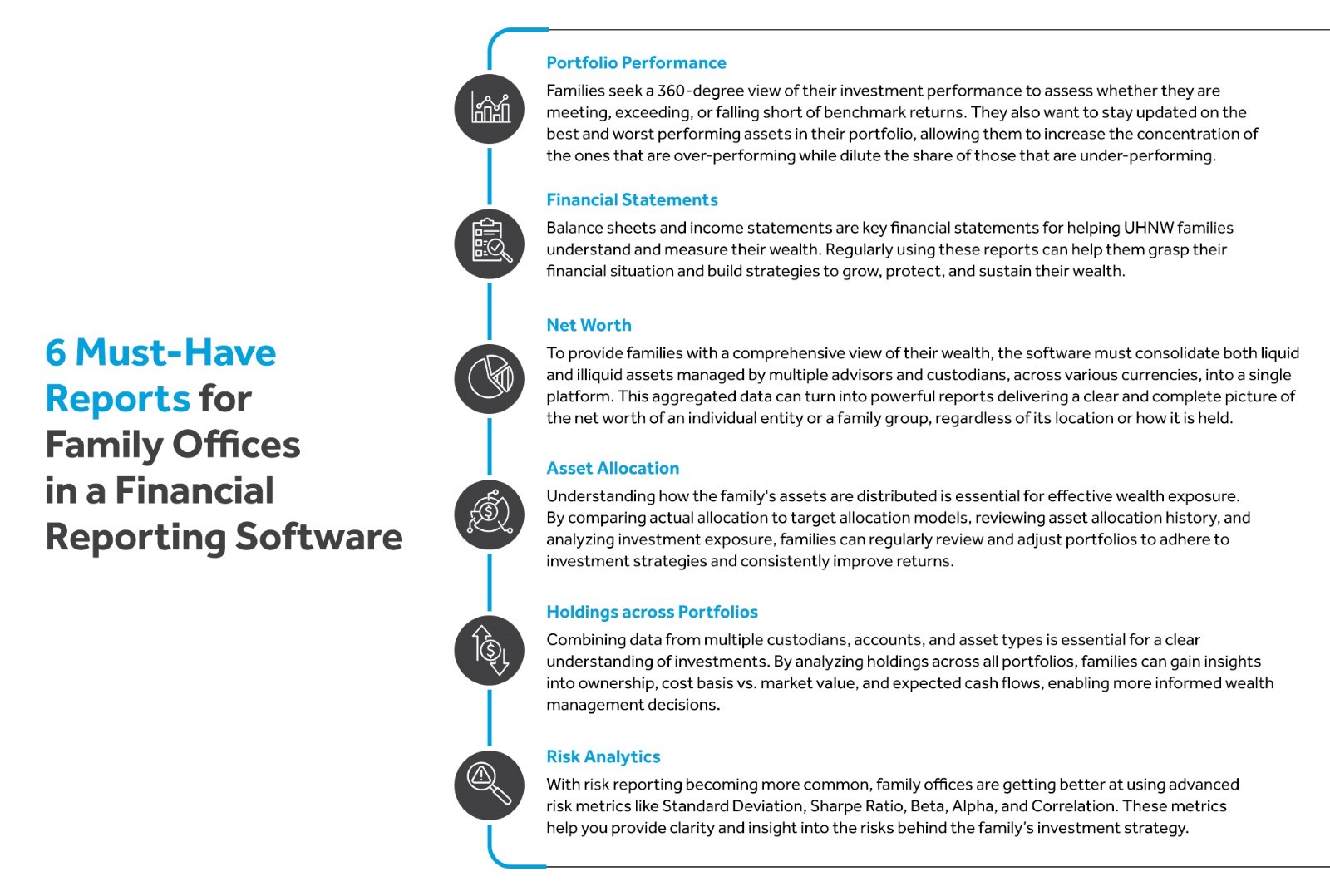

Countless types of financial reports can be created based on the diverse needs of families. However, here are the 6 most important reports that a Family Office Management Software must be able to generate: 1. Portfolio Performance — Evaluating returns with precision

Performance reports allow UHNW families to get a snapshot of how their investments are performing over a particular time range (e.g. weekly, monthly, quarterly, yearly, etc.) and with respect to a benchmark of choice. Here are four essential performance reports you can expect from an advanced family office management software:

1. Portfolio Performance — Evaluating returns with precision

Performance reports allow UHNW families to get a snapshot of how their investments are performing over a particular time range (e.g. weekly, monthly, quarterly, yearly, etc.) and with respect to a benchmark of choice. Here are four essential performance reports you can expect from an advanced family office management software:

- Time-Weighted Returns (TWR): Helps evaluate portfolio performance over time without accounting for external cash flows, such as contributions and withdrawals. By excluding cash flows, it allows comparing the performance of different investment managers and strategies in an unbiased manner.

- Internal Rate of Return (IRR): Also referred to as “money-weighted return”, it enables measuring the actual returns generated by an individual investor by considering the size and timing of all cash flows. It’s more suitable for evaluating the performance of illiquid assets where cash flows are irregular.

- Performance attribution: Allows families to determine which asset class (e.g. equities, bonds, real estate) is driving their portfolio returns. It helps to identify high-performing securities that have the potential to deliver above-market returns and adjust portfolios according to market trends.

- Peer and benchmark comparison: Enables families to identify whether their portfolio is under-performing, matching, or over-performing the selected benchmark. By identifying areas of weakness, families can adopt course-correction steps to optimize their portfolio.