Read Time5 Mins

Accounting is the soul of finance and, therefore, forms the bedrock of any business. However, as with any other industry, it’s not untouched by the relentless disruption brought about by AI and automation. Traditionally, accounting has been dominated by Reagan-era software, and any call for change has been deemed tantamount to high treason.

But with AI ready to hammer down its golden nail, this industry is on the brink of a digital revolution. However, before delving deep into the challenges in the accounting industry and exploring how integrated accounting software can really help, let’s do some number crunching to understand why this profession is so important.

How will AV continue to be the ultimate integrated accounting software solution to address evolving accounting challenges?

Asset Vantage is a leading integrated accounting software that consolidates data from custodians and bank feeds while integrating with a robust general ledger, an efficient document vault and a powerful performance reporting tool.

This provides a complete picture of assets —both liquid and illiquid—to over 300 of the world’s wealthiest families, representing combined assets worth $300 billion+. Our large client base spread across the Americas, UK, Middle East, Asia, and Oceania gives us the unique distinction of being a truly global service provider.

Here’s how AV’s unparalleled integrated general ledger helps accountants perform their work at the highest level:

How will AV continue to be the ultimate integrated accounting software solution to address evolving accounting challenges?

Asset Vantage is a leading integrated accounting software that consolidates data from custodians and bank feeds while integrating with a robust general ledger, an efficient document vault and a powerful performance reporting tool.

This provides a complete picture of assets —both liquid and illiquid—to over 300 of the world’s wealthiest families, representing combined assets worth $300 billion+. Our large client base spread across the Americas, UK, Middle East, Asia, and Oceania gives us the unique distinction of being a truly global service provider.

Here’s how AV’s unparalleled integrated general ledger helps accountants perform their work at the highest level:

Numbers hint at an impending cyclone of change in the accounting industry

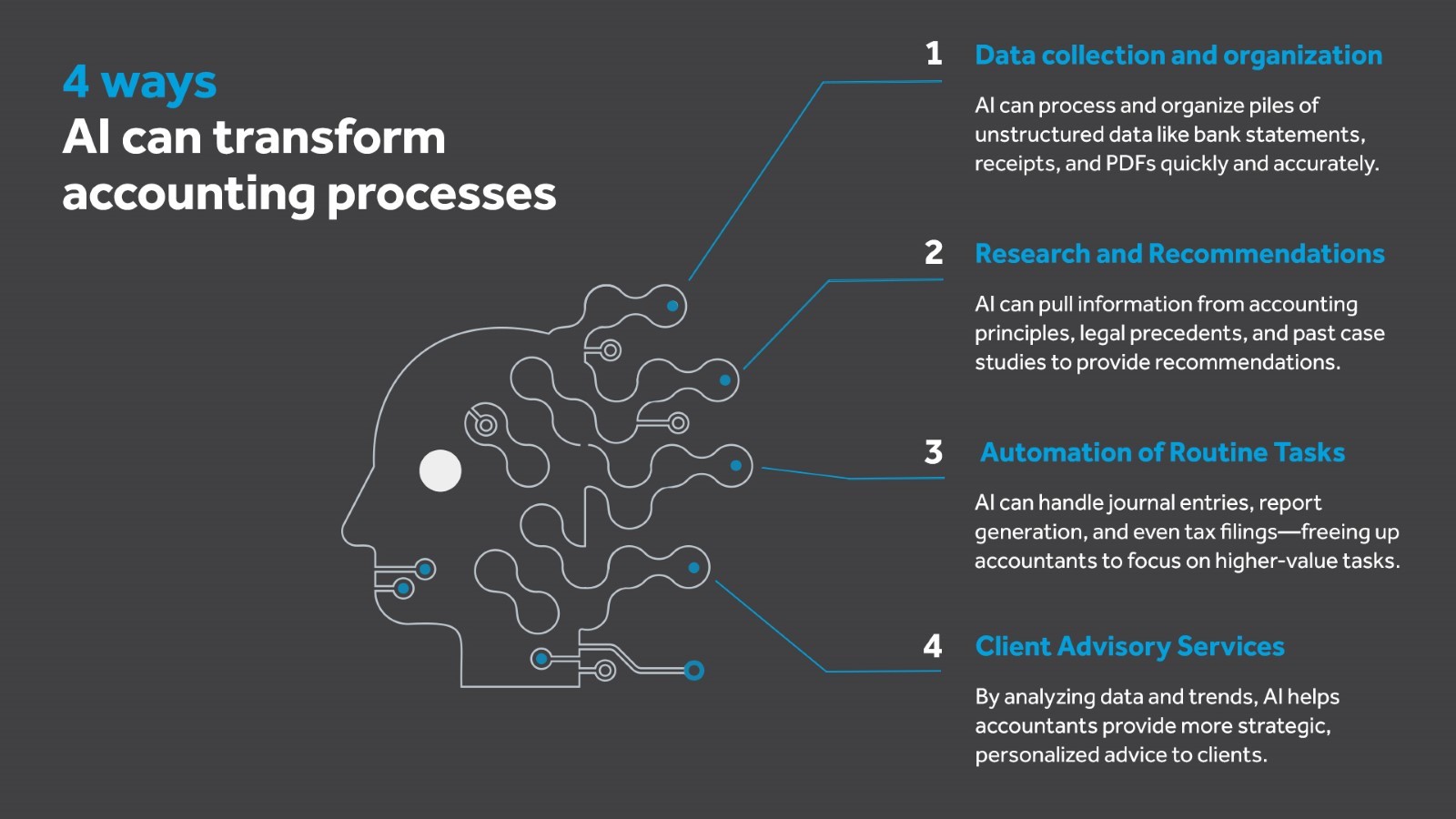

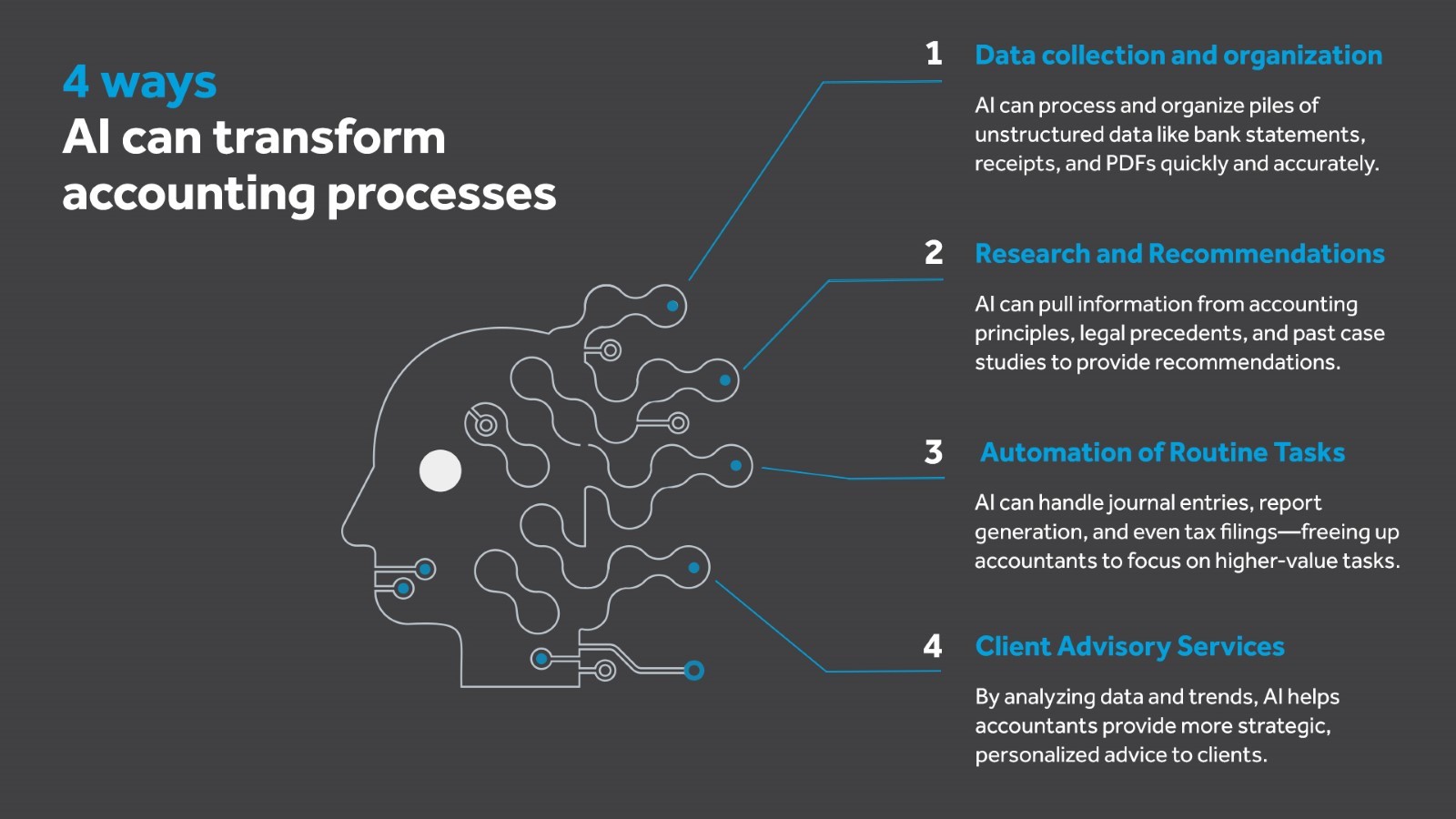

Imagine if a huge chunk of work—especially tasks that are repetitive in nature, like data entry—could be automated. Wouldn’t that put more time in the hands of accountants to focus on more meaningful tasks such as planning for capital investments, providing tailored advisory services, and demystifying complex tax structuring? Also, since low-quality tasks will be automated, wouldn’t that translate to faster services for clients, further cementing the trust in the relationship? But the road is not as rosy as it seems. According to Statista, 1.4 million accountants and auditors exist in the U.S. alone, and this number swells to 3 million when we include related roles such as auditing clerks and bookkeepers. The mass adoption of AI could mean a wave of widespread termination for accountants, especially those who are ill-equipped to handle cutting-edge technology. This could have serious repercussions for the accounting industry which is already battling with a declining workforce in recent years. Also Read: The Evolution of Family Offices for Modern Needs3 challenges that are wreaking havoc in the accounting industry

1.The workforce is shrinking

Inundated with challenges such as an aging workforce, a sharp decline in the entry of new Certified Public Accountants (CPAs), and a massive exodus of qualified talent, the accounting industry paints a rather grim picture, as shown in the points below:- According to AICPA, 75% of CPAs in the system today will retire in the next 15 years, highlighting a huge void due to an aging population.

- Another report by AICPA reveals that the number of CPA exam candidates has fallen from 72,271 in 2021 to 67,335 in 2022, signalling a decline in CPA test takers.

- Based on statistics shared by the Bureau of Labor Statistics, the median salary of accountants was $79,880 as of 2023.

- A report by Indeed shows that entry-level accountants are making about $51,494 a year. Adding to it the fees of coursework and licensure gives a clear picture of why it doesn’t pay to become a CPA.

- Accounting jobs are highly demanding, especially during peak season when accountants can work well over 40 hours a week. This happens primarily due to over-dependence on outdated technology and tight deadlines.

How will AV continue to be the ultimate integrated accounting software solution to address evolving accounting challenges?

Asset Vantage is a leading integrated accounting software that consolidates data from custodians and bank feeds while integrating with a robust general ledger, an efficient document vault and a powerful performance reporting tool.

This provides a complete picture of assets —both liquid and illiquid—to over 300 of the world’s wealthiest families, representing combined assets worth $300 billion+. Our large client base spread across the Americas, UK, Middle East, Asia, and Oceania gives us the unique distinction of being a truly global service provider.

Here’s how AV’s unparalleled integrated general ledger helps accountants perform their work at the highest level:

How will AV continue to be the ultimate integrated accounting software solution to address evolving accounting challenges?

Asset Vantage is a leading integrated accounting software that consolidates data from custodians and bank feeds while integrating with a robust general ledger, an efficient document vault and a powerful performance reporting tool.

This provides a complete picture of assets —both liquid and illiquid—to over 300 of the world’s wealthiest families, representing combined assets worth $300 billion+. Our large client base spread across the Americas, UK, Middle East, Asia, and Oceania gives us the unique distinction of being a truly global service provider.

Here’s how AV’s unparalleled integrated general ledger helps accountants perform their work at the highest level:

- Provides actionable views of family wealth by consolidating and reconciling financial transactions across multiple systems.

- Reduces manual data entry and minimizes errors by automating data aggregation efforts.

- Helps make informed decisions by generating customized performance reports based on user-defined tags such as advisors, sectors, geographies, etc.

- Optimizes tax efficiency and manages liquidity through short-term and long-term gains reports.

- Provides reports in preferred currency by maintaining accounts in multiple currencies and locations.

- Standardizes financial reporting through adherence to IFRS and GAAP standards.

- Custom filters and drill-down capabilities provide detailed insights into transactions and journal entries.

- Documents are tagged to specific transactions, enabling easier retrieval.