Read Time2 Mins

The Disconnect: Why Traditional Models Fall Short

The Deloitte Family Office Insights report found that 30% of heirs feel unprepared to manage family wealth—often because they’ve grown too reliant on advisors. Here’s why that matters:

- They don’t get real experience. Top-line summaries won’t build financial acumen. Without direct access to data, heirs struggle to make high-stakes decisions.

- They become dependent. When every move runs through an advisor, heirs don’t develop independent thinking. That slows decision-making and weakens strategy.

- Older generations hold back access. Families worry that too much transparency leads to entitlement. But in reality, a lack of transparency leads to disengagement.

If heirs aren’t financially confident, succession plans collapse. The fix? Bring them in early and make transparency the foundation of wealth transfer.

Transparency: The Key to Engaging Heirs

Most family offices believe their next generation is ready to lead. The reality? Many heirs have never had real visibility into how wealth is actually managed.

Transparency isn’t about dumping financial reports on the next-gen, it’s about active involvement. When heirs see real numbers and strategy in action, they ask better questions, build confidence, and contribute meaningfully.

Take the Lipitz Family Office (featured in Wealth Strategies Journal). By giving heirs real-time access to financial data and investment reports, they transformed passive beneficiaries into engaged decision-makers.

Leveraging Technology for Heir Engagement

Many family-offices struggle with granting financial access while maintaining governance. That’s where the right technology can significantly change the game.

Smart financial systems give next-gen heirs controlled access without compromising governance.

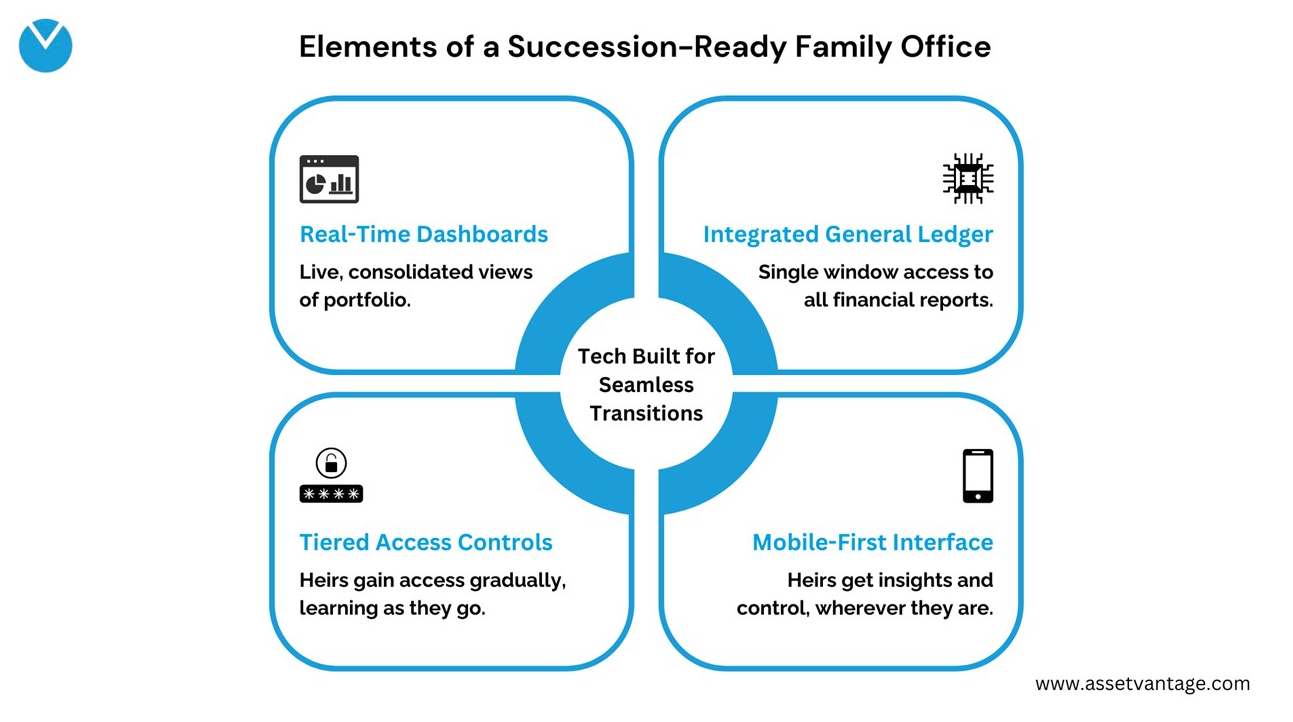

Here’s how Asset Vantage – a modern family office software enables smooth succession:

- Real-Time Reports – Instead of scattered reports, heirs get a single source of truth, up-to date insights into investments, liquidity, and asset performance.

- Custom Dashboards – Fully configurable dashboards allow the next-gen to setup a view of reports aligned to their preferences and priorities.

- Integrated General Ledger -Gives heirs a clean, reliable financial foundation by automating complex accounting and simplifying insights on income and expenses.

- Tiered Access Controls – Heirs start with portfolio overviews and gradually gain deeper financial access, ensuring they learn at the right pace.

- Mobile-First Financial Management – Wealth isn’t just managed in boardrooms anymore. Mobile-first platforms let heirs stay informed and act when needed, from anywhere.

Securing Family Wealth for the Long Haul

By embracing transparency, families not only prepare heirs for the financial responsibility ahead but also fortify their legacy against the risks of disengagement, inefficiency, and outdated decision-making models.

With Asset Vantage, an integrated reporting and accounting solution,family offices are streamlining operations and creating a structured and transparent system that empowers heirs while maintaining governance and security.

Book a demo today to find out how hundreds of global families are staying future ready.